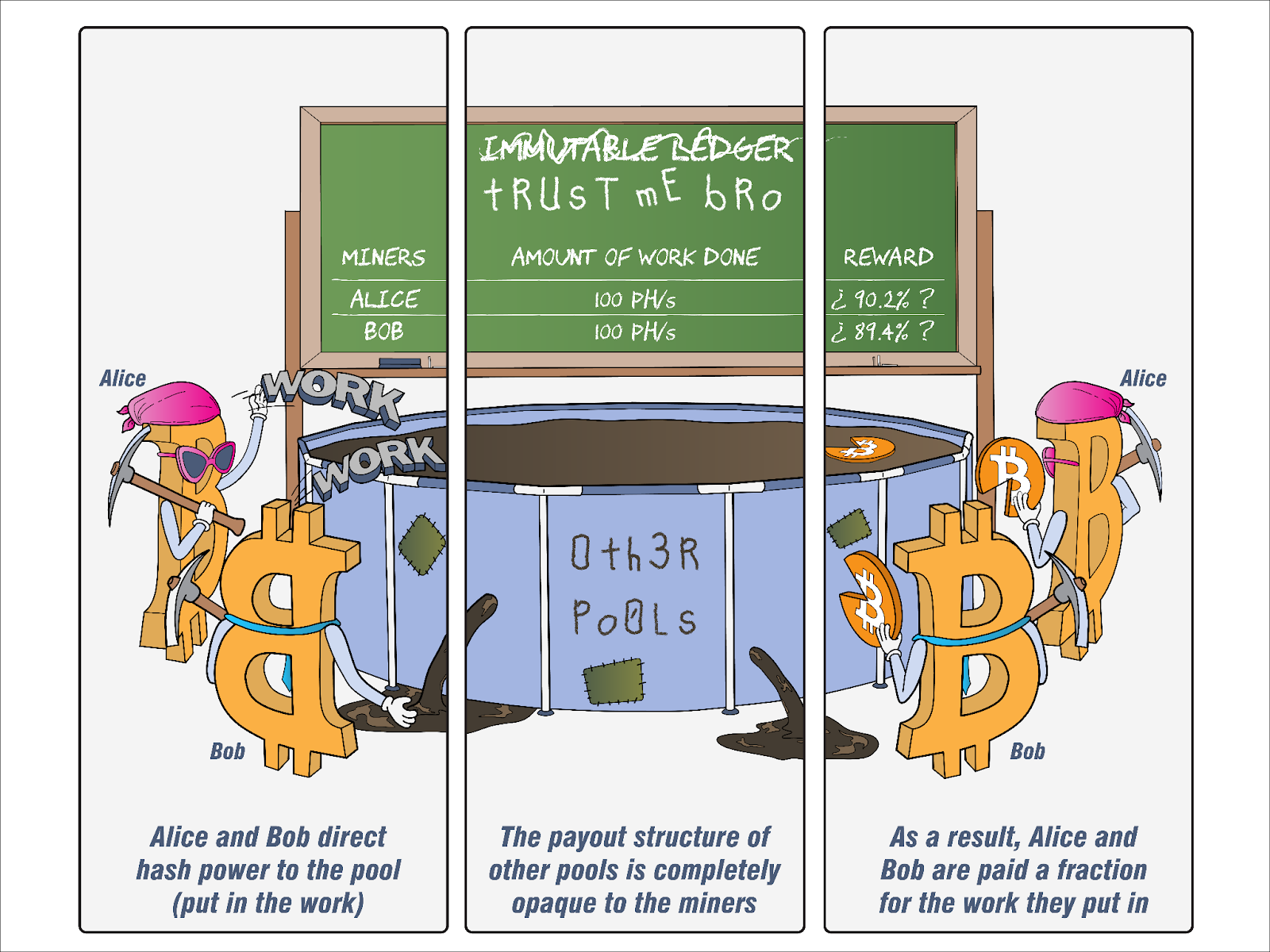

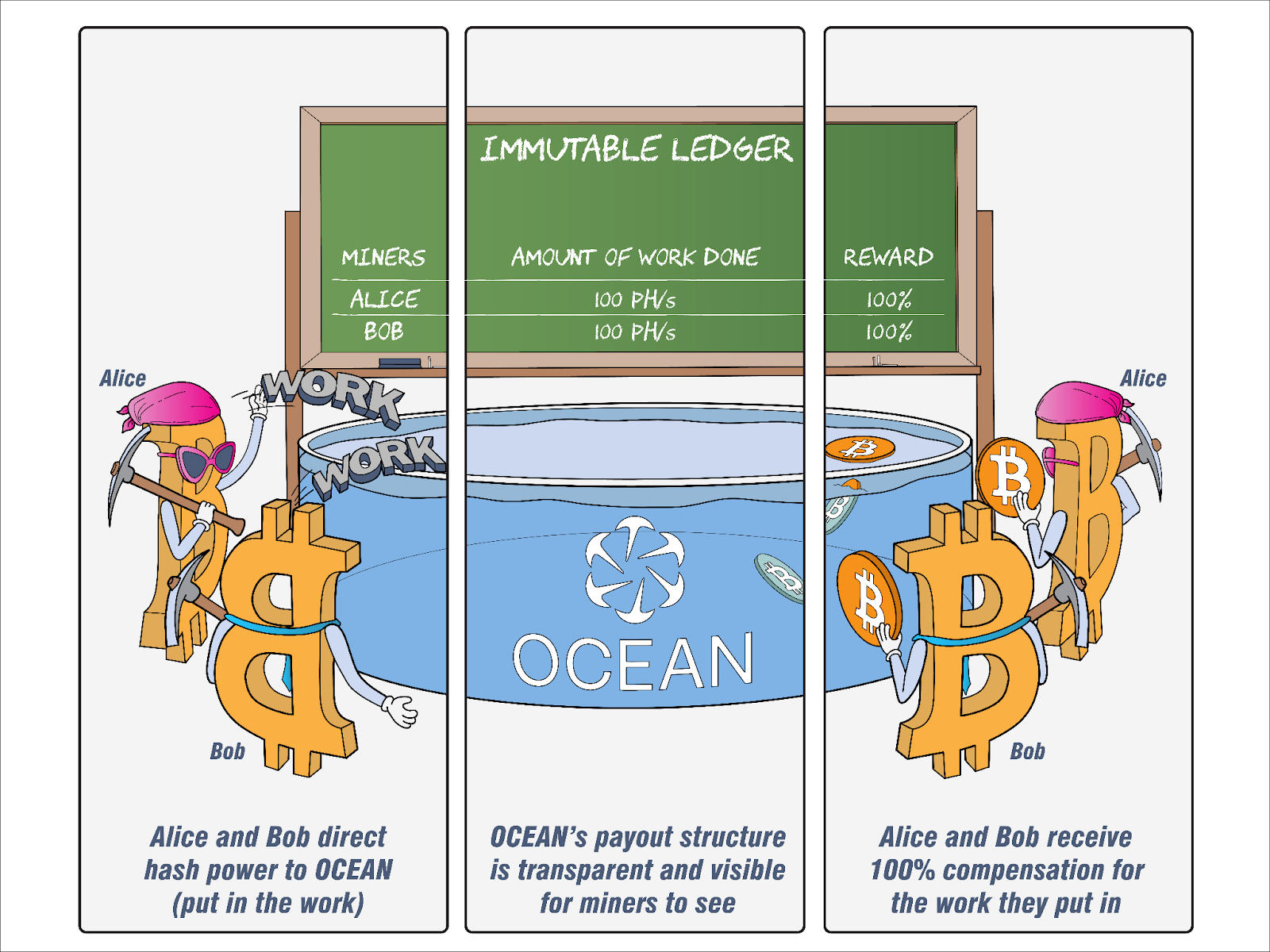

Moving into 2026, we're publishing a series of blog posts to introduce new users to the Lightning Network protocol. These posts will explain the protocol's high-level functionality and the rationale behind our design choices, all while ensuring the preservation of OCEAN’s core mission: building a decentralized future within Bitcoin mining.

The Bitcoin blockchain has revolutionized finance by providing a decentralized, secure way to transfer value. However, as adoption grows, its limitations become apparent: transactions can be slow and expensive due to the network's design, where new blocks are added roughly every 10 minutes. This is where the Lightning Network comes in—a Layer-2 protocol built on top of Bitcoin that enables instant, low-cost payments while preserving the underlying security of the blockchain. In this post, we'll break down what the Lightning Network does, how it works, and why it's a game-changer. We'll also dive into advanced features like BOLT12 offers, and introduce OCEAN’s seamless integration for Lightning payouts, making it easier for miners and users to leverage this technology.

Bitcoin's blockchain is like a global ledger where every transaction is recorded permanently. While this ensures security and immutability, it creates bottlenecks. With limited block space, fees can spike during high demand, and confirmations take time—making Bitcoin less ideal for everyday micropayments, like buying a coffee or tipping online.

The Lightning Network addresses these issues by moving most transactions "off-chain". It allows users to conduct unlimited payments between parties without burdening the main Bitcoin blockchain for every single transfer. Only the net results are settled on-chain when needed. This scalability boost turns Bitcoin into a practical payment system, much like how email protocols layered on the internet enabled instant communication.

At its core, the Lightning Network uses payment channels—secure, bilateral agreements between two parties. Here's a step-by-step breakdown:

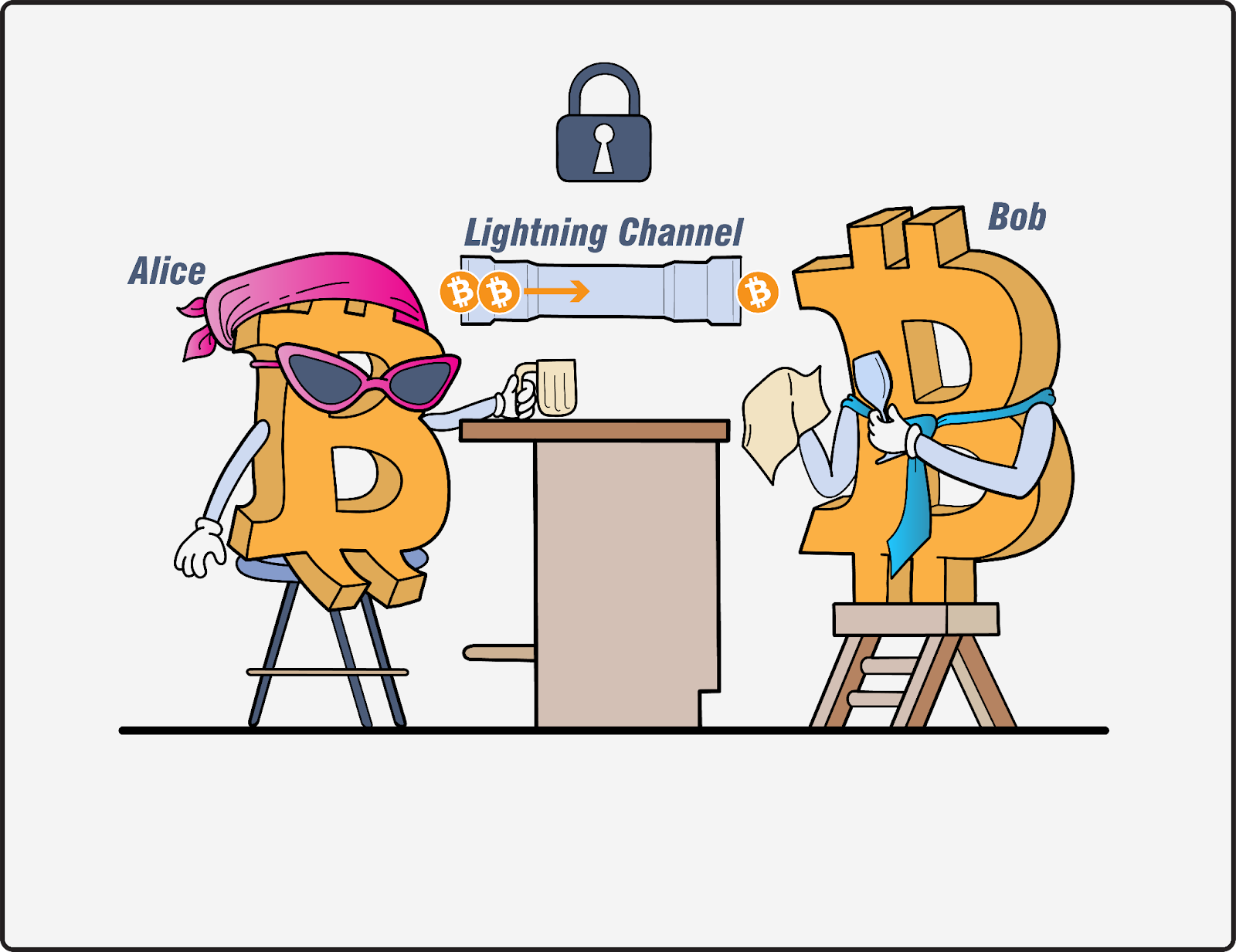

- Opening a Channel: Two users (e.g., Alice and Bob) lock up some Bitcoin in a shared, on-chain multisig address (requiring both signatures to spend). This initial transaction is recorded on the Bitcoin blockchain.

- Off-Chain Transactions: Within the channel, Alice and Bob can exchange funds instantly by updating their balance commitments. These updates are cryptographic promises (using HTLCs—Hashed Time-Locked Contracts) that don't hit the blockchain yet.

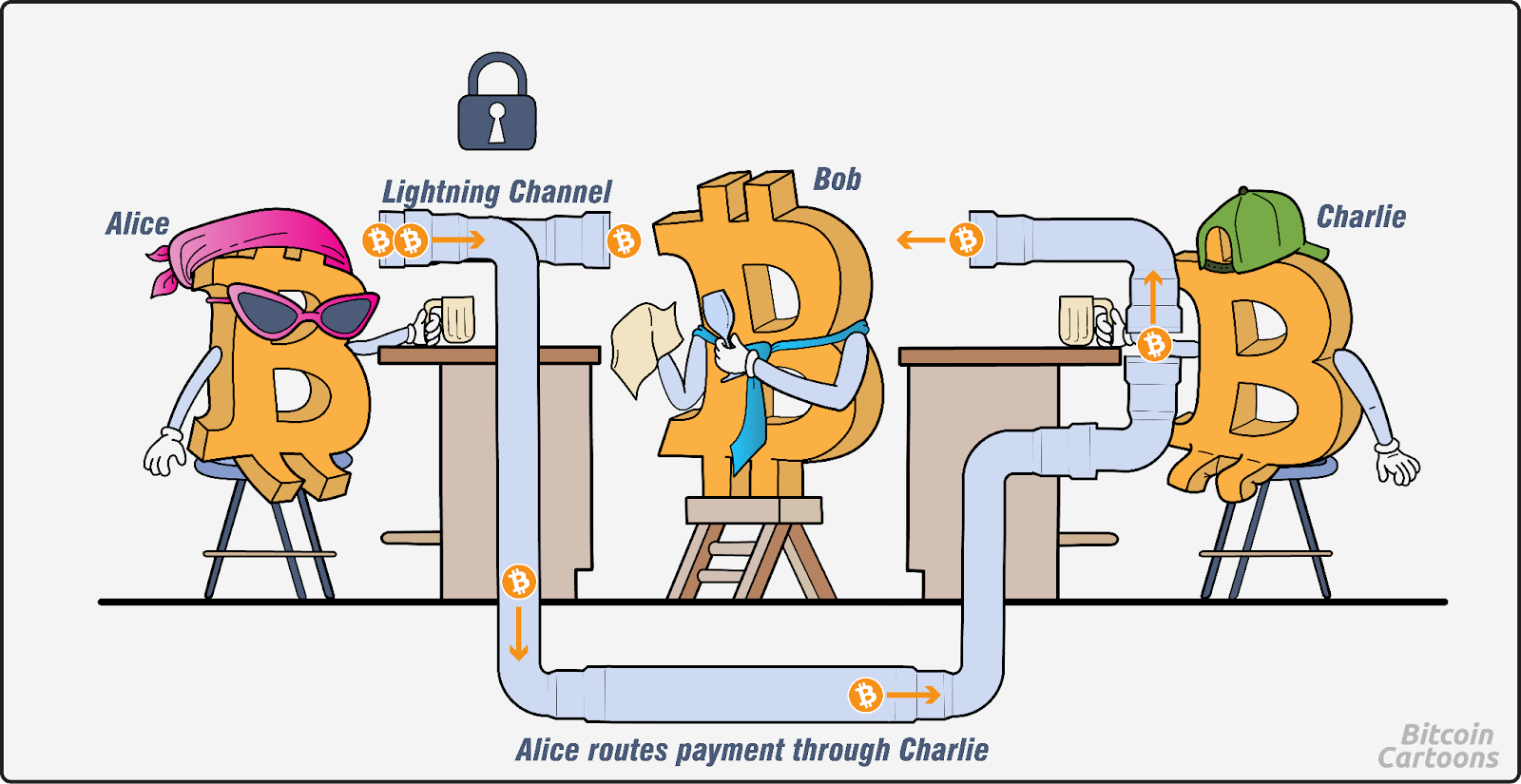

- Routing Across the Network: If Alice wants to pay Bob (who doesn't have a direct channel with her), the network routes the payment through intermediaries (like Charlie). This is powered by a mesh of interconnected channels, where nodes forward payments for tiny fees.

- Closing the Channel: When done, the final balances are settled on-chain. If there's a dispute, the blockchain enforces the latest valid state.

This setup is analogous to running a tab at a bar: you only settle the bill at the end, avoiding a separate payment for each drink. The result? Transactions that settle in seconds for fractions of a penny.

The Lightning Network unlocks Bitcoin's potential in ways the base layer can't:

- Scalability: It can handle millions of transactions per second off-chain, far beyond Bitcoin's ~7 TPS limit.

- Low Fees: Ideal for microtransactions, with costs often under $0.01—perfect for tipping, streaming payments, or IoT devices.

- Instant Settlements: No waiting for block confirmations; payments are final in milliseconds.

- Enhanced Privacy: Off-chain transactions aren't publicly broadcast, reducing on-chain footprints.

- New Use Cases: Enables innovations like pay-per-minute content or automated machine-to-machine payments.

However, it's not without drawbacks. Setting up channels requires on-chain transactions (which can be costly during congestion), and users need some technical know-how or user-friendly wallets. Routing can sometimes fail if liquidity is low, but the ecosystem is maturing rapidly.

Lightning is already powering real-world scenarios:

- Microtransactions: Tip podcasters on platforms like Fountain or pay for digital content per article/view.

- Instant Retail Payments: Merchants accept Bitcoin in-store without delays, rivaling credit cards.

- Cross-Border Remittances: Send money globally with minimal fees, bypassing traditional banking hurdles.

- Machine-to-Machine Economy: Electric vehicles could pay for charging autonomously, or smart devices handle micropayments for data/services.

As of mid-2025, the network boasts over 11,000 nodes, thousands of channels, and billions in locked value, with adoption surging in regions like Latin America for low-cost transfers.

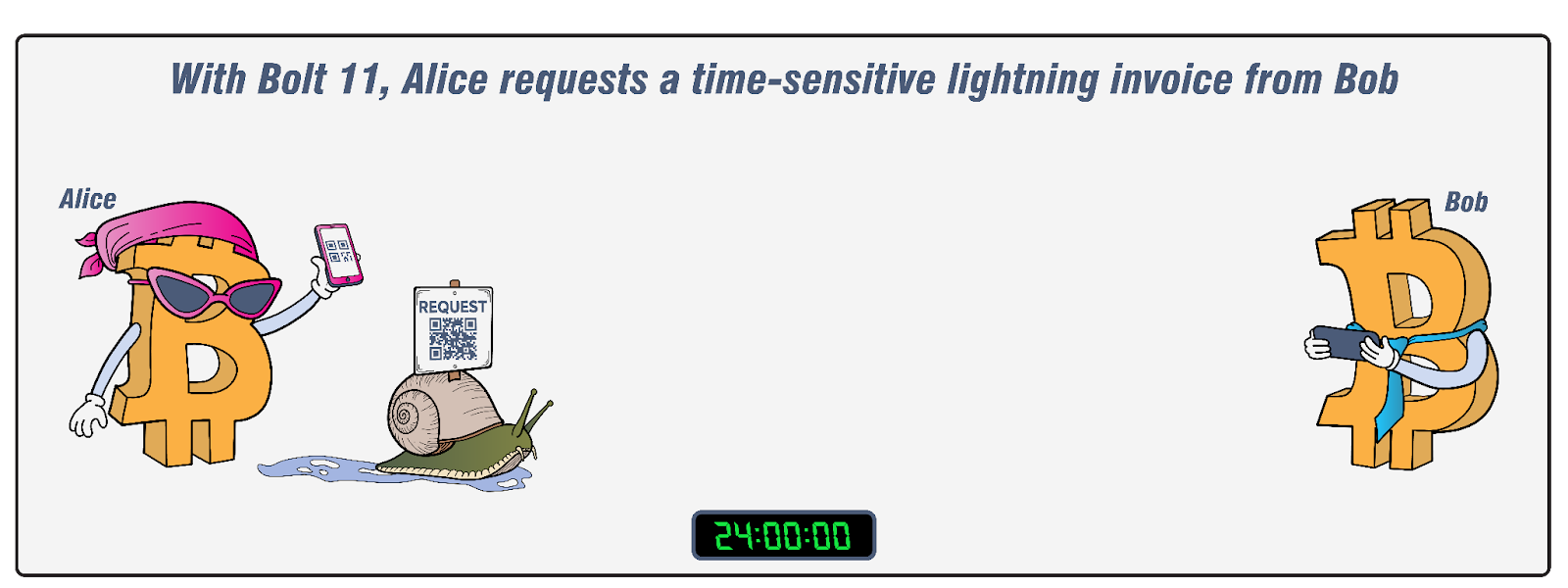

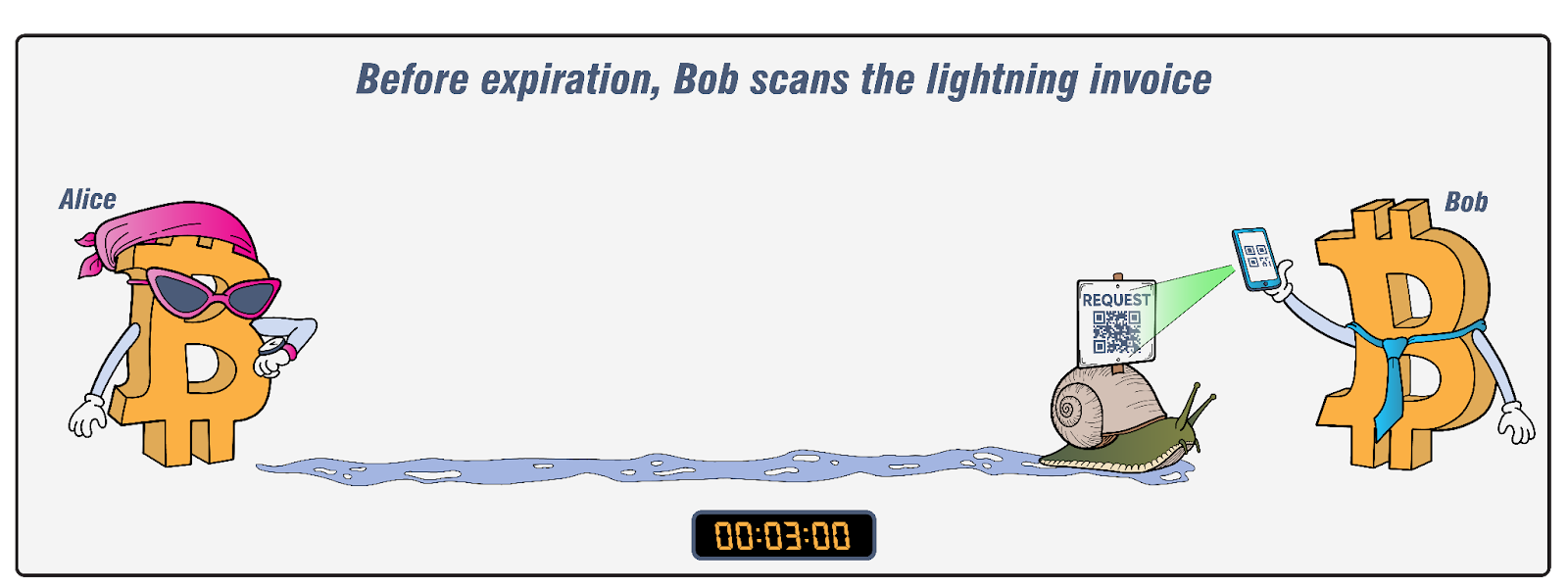

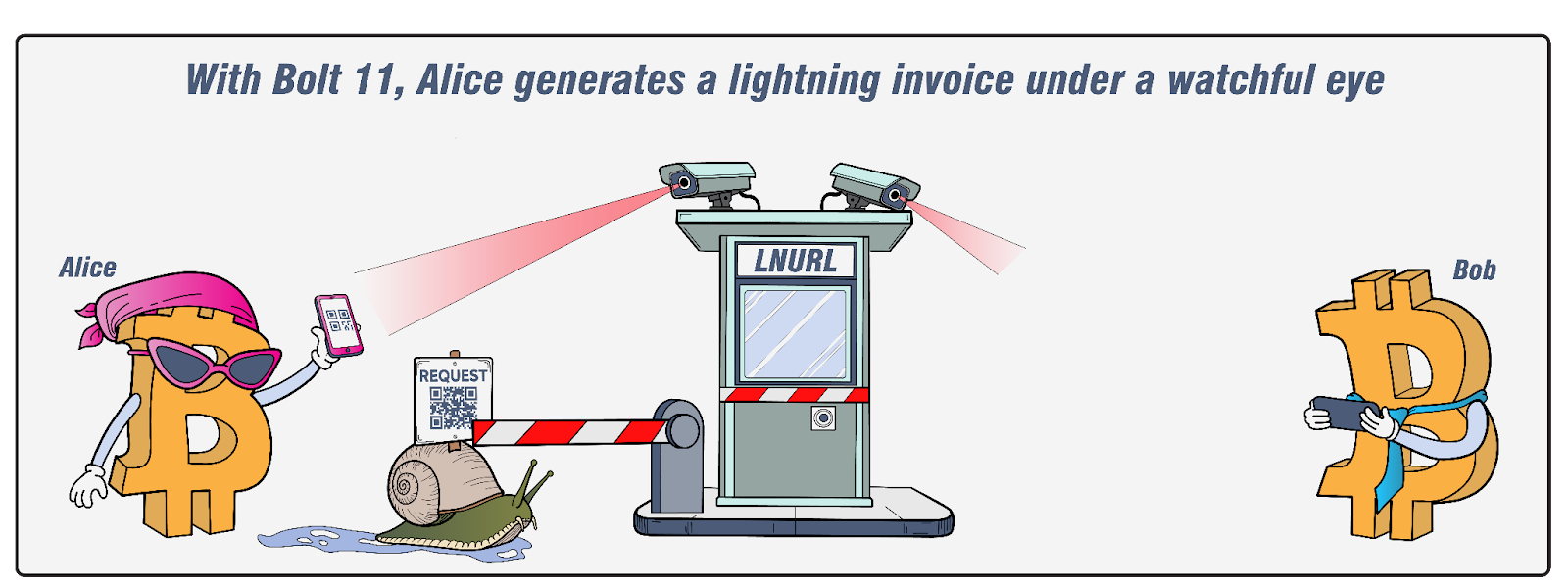

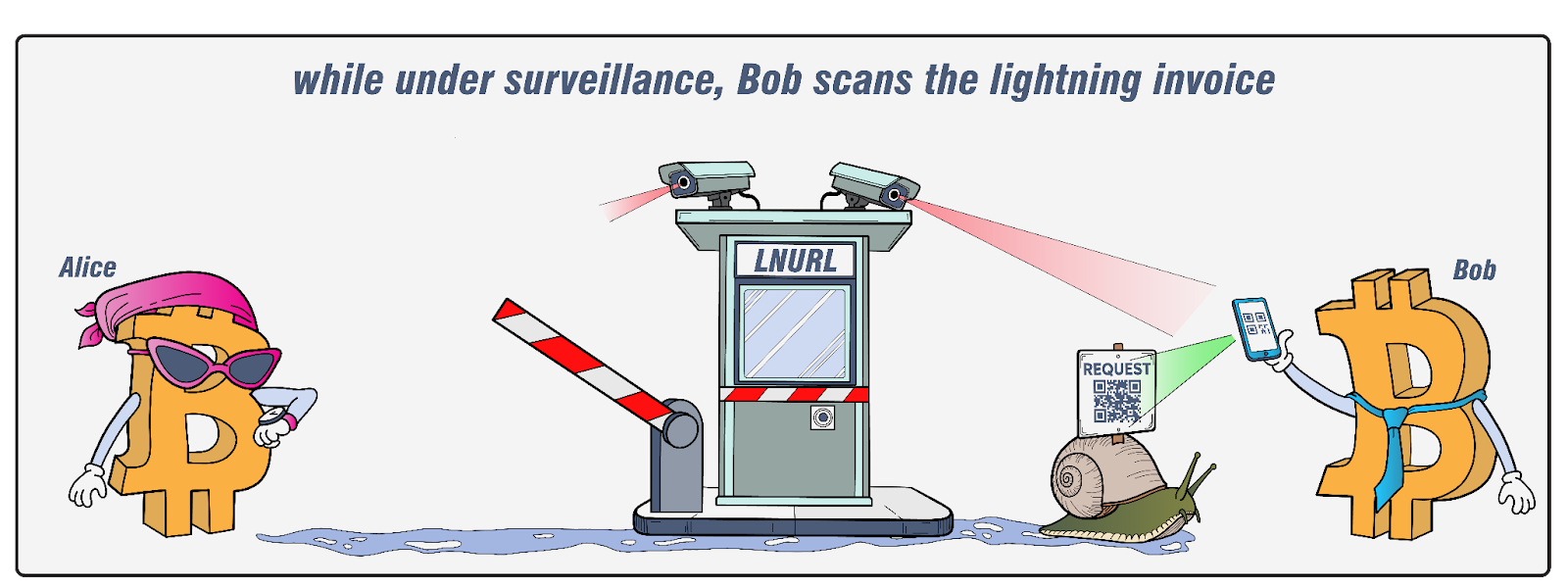

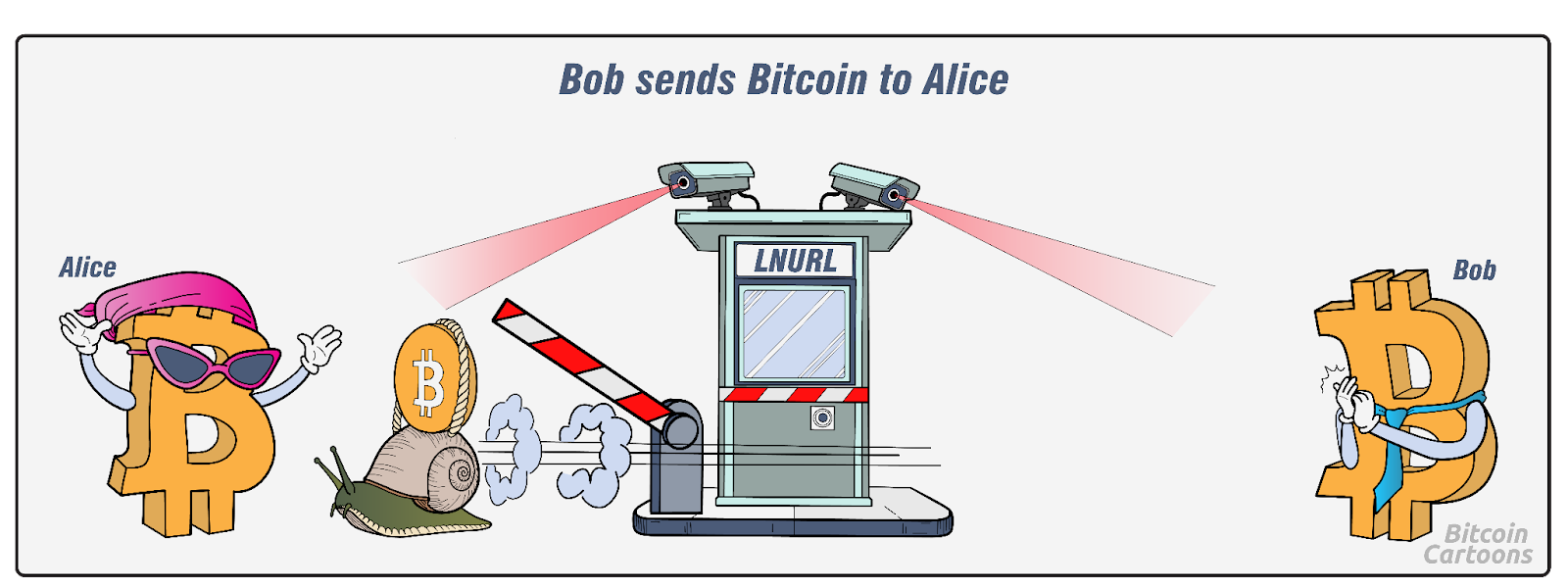

Before diving into the advancements of Bolt 12, it's crucial to understand its predecessor, Bolt 11, and its inherent limitations. Bolt 11, formally known as "Lightning Network Invoice Protocol" is the foundational standard for creating payment requests on the Lightning Network. Essentially, a Bolt 11 invoice is a specially formatted string of characters that contains all the necessary information for a payment to be made, including the recipient's Lightning Network node ID, the amount to be paid, a description of the payment, and a hash of the payment preimage. When a user wants to receive a payment, their Lightning wallet generates a unique Bolt 11 invoice, which they then share with the sender. The sender's wallet decodes this invoice, routes the payment through the Lightning Network, and settles the transaction.

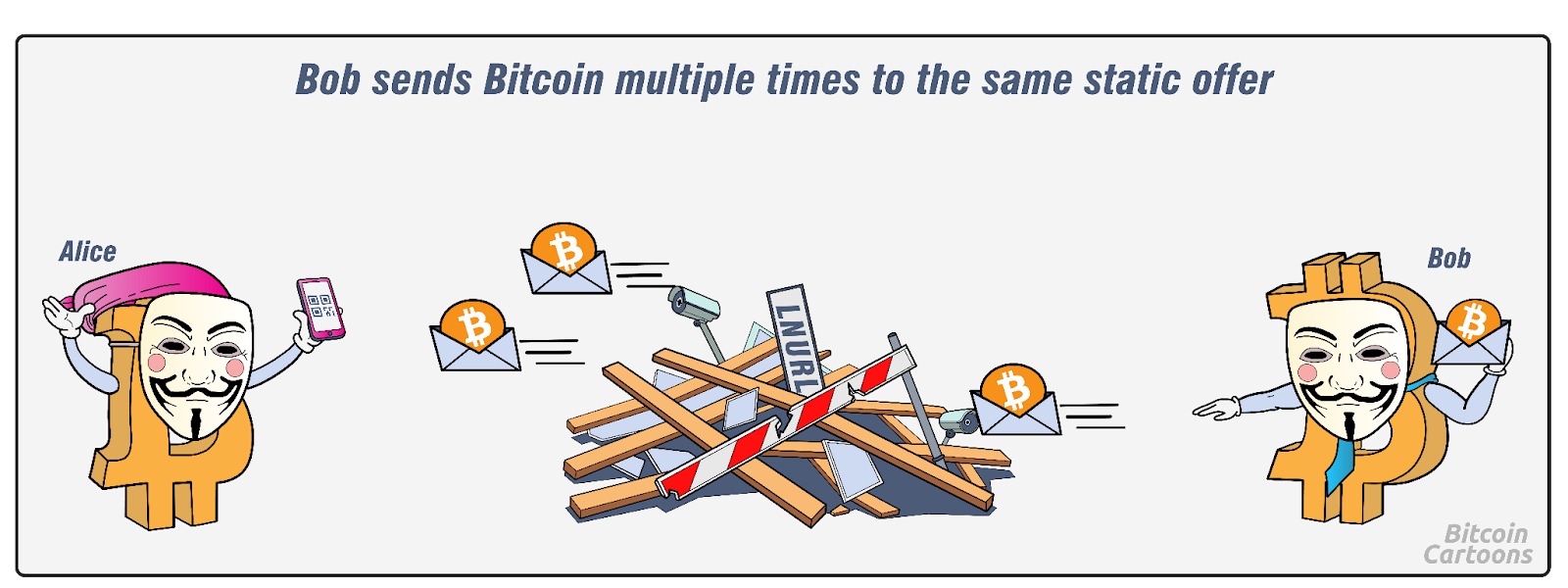

While revolutionary for enabling faster and cheaper Bitcoin transactions, Bolt 11 invoices come with significant drawbacks. A primary limitation is their single-use nature. Each Bolt 11 invoice is designed for a specific, one-time payment. This means that for recurring payments or for a merchant accepting multiple payments from different customers, a new invoice must be generated for every single transaction. This can be cumbersome and inefficient, particularly for services requiring frequent payments or for large-scale e-commerce operations. The static nature of Bolt 11 also presents privacy concerns, as a new invoice often means a new payment hash, which can make it easier to link payments to specific recipients if not carefully managed. These limitations highlight the need for a more flexible and robust invoicing system, paving the way for the innovations introduced with Bolt 12.

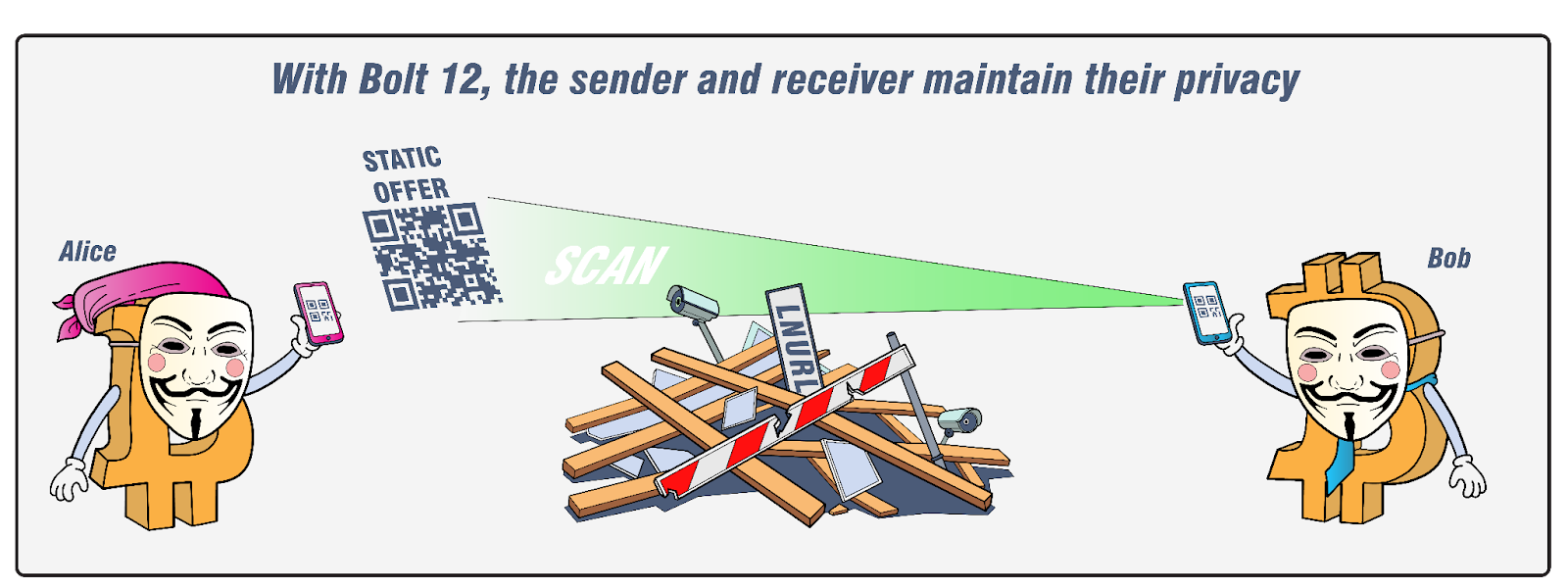

BOLT12 represents a significant advancement in the Lightning Network protocol, primarily through its introduction of "offers." Unlike the traditional, single-use invoices that require a new generation for each payment, BOLT12 offers are static and reusable. This innovative feature allows a single offer to be shared widely and utilized repeatedly to request payments without the constant need to generate new invoices.

This persistent payment request functionality is particularly valuable. It can be likened to having a permanent, publicly accessible email address for receiving messages, but for payments. This simplifies the process for individuals and businesses to receive payments on an ongoing basis, eliminating the operational overhead of continually issuing new invoices.

Beyond convenience, BOLT12 also introduces enhanced privacy for receivers. By carefully managing how a Lightning node generates a BOLT12 offer, it is possible to obscure certain details, thereby increasing the privacy of the recipient in the payment transaction. This additional layer of privacy is a crucial benefit, further strengthening the appeal of the Lightning Network for various use cases.

Building on Lightning's foundations, BOLT12 introduces "offers"—static, reusable Lightning "addresses" that function like email addresses for payments. Unlike one-time invoices, a BOLT12 offer can be shared publicly (e.g., on a website or profile) and used repeatedly to request payments without generating new codes each time.

BOLT12 has a long list of use cases that people may not realise at first when using it, but if you are curious about them, you can look at the BOLT12 User Story.

In practice, BOLT12 verification mirrors on-chain proofs—using tagged hashes and signatures per the BOLT12 spec—to confirm invoice requests aren't tampered with, making it secure for high-value or recurring transfers.

At OCEAN, we're making Lightning even more accessible for Bitcoin miners by supporting Lightning payouts directly from your earnings. Our process uses BOLT12 offers for privacy and efficiency, with a simple signing step to link your OCEAN Bitcoin address to your Lightning setup.

Here's how it works:

- Generate a BOLT12 offer in a compatible wallet like Core Lightning (CLN), which supports BOLT12 experimentally, as well as Alby and Phoenix wallets.

- On your OCEAN dashboard (My Stats page), paste the offer and current block height.

- OCEAN generates an unsigned message tying your on-chain address to the offer.

- Sign this message using your on-chain wallet or signing device—it must support message signing.

- Submit the signature to confirm.

For signing, you can use any Bitcoin address, as this follows BIP-137, BIP322, or Electrum's non-standard signature format. It is crucial that your Lightning node possesses inbound liquidity; without it, payouts will revert to on-chain transactions once thresholds are reached.

This integration lets miners receive rewards instantly via Lightning, reducing fees and wait times. It's part of our commitment to advancing Bitcoin's ecosystem—join OCEAN today to experience the future of mining payouts!

For more details on Lightning setup, check out https://ocean.xyz/docs/lightning. If you're new to BOLT12, explore implementations like those in albihub or Phoenix wallet.